Financing origination application can help cut down on what can end up being a costly, time-drinking processes. Is all you need to see

- What is actually that loan origination application?

- Do you know the advantages of mortgage origination application?

- What is actually an electronic digital loan origination system?

- Exactly what are the values of one’s mortgage origination techniques?

The loan mortgage origination processes is going to be costly and you can big date-ingesting. This is when real estate loan origination app (LOS) comes in useful. A beneficial home mortgage origination software simplifies the mortgage app process and you may helps to make the exchange, regarding origination so you can closure, a breeze.

Exactly what precisely was loan origination application? Exactly what are the trick advantages? And you can which components of the borrowed funds origination processes can it express?

What’s a loan origination application?

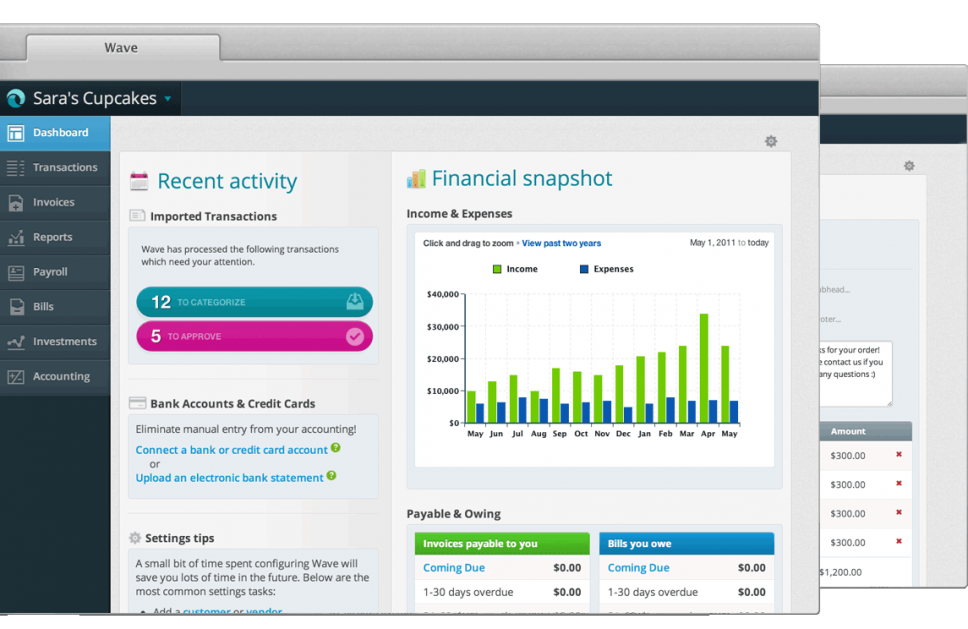

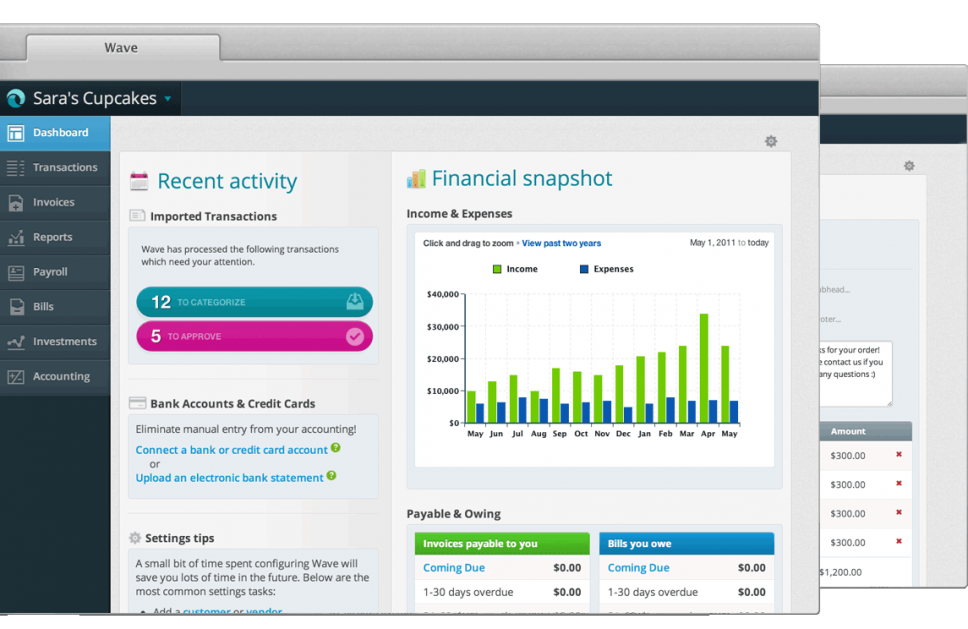

Loan origination software (LOS) permits creditors to help you speed up and create the newest workflow of the many strategies of one’s credit techniques. New steps in the borrowed funds origination process that these software is most useful useful for include:

- Application for the loan

- Underwriting

- Borrowing from the bank approval

- Documentation

- Rates

Mortgage origination application plus integrates along with other side- and right back-prevent programs from lenders to exchanged interaction and studies getting delivering a seamless electronic financing feel. Additionally, financing origination app complies with industry and you can regulatory conditions to eliminate coverage breaches and you will manage users’ data. Usually, financing origination software program is utilized by creditors to deal with this new activities out of users, shopping, industrial, SBA, SME, otherwise mortgage credit-everything in one centralized space.

Mortgage origination app lets pages to deal with and you will speed up all of the grade of one’s credit procedure, sets from data collection to fund disbursement to help you digitizing the complete feel. This allows mortgage brokers to processes and you can agree (or refuse) mortgage brokers easier. But that isn’t the only upside in order to loan origination app.

1. Increased customer sense

File processes during the financial origination and you will intimate is time-sipping, between a few weeks in order to, oftentimes, period. After you reason for a large number of borrowers has household and you may full-go out perform, coordinating with loan providers can be even more complicated. Thanks to this mortgage origination app will come in; they not only simplifies operations however, digitizes https://paydayloanalabama.com/vandiver/ the procedure, making it simpler getting customers-and you may boosting their experience.

dos. A whole lot more accuracy

Whenever making an application for a home loan, lenders are going to be forced to remove a keen applicant’s guidance out of multiple present. Because manual study entry will likely be likely to problems, it takes additional time about mortgage technique to augment it. Although not, financing origination application automates the process and provides works which is less prone to mistake. The result is more reliability plus faster handling.

step 3. Highest returns

Repetitive employment regarding home loan app techniques-including multiple connections ranging from debtor and lender, records, settling words, an such like.-allow it to be hard to intimate sale shorter. By simplifying the process, mortgage origination software advances efficiency significantly. Getting rid of misplaced records and you can accelerating new comment techniques form loan providers can personal way more lenders inside the a shorter time.

cuatro. Most useful decision making

Because it automates the guidelines software must meet the requirements, mortgage origination software is approve licensed applicants smaller. This mortgage software also can quicker refuse individuals who’ve zero credit rating otherwise bad credit, freeing right up lenders to the office a lot of perseverance to your increasing its providers.

5. Enhanced ripoff identification

Financing origination software lets mortgage brokers to help you leverage the strength of predictive statistics to compliment scam recognition. This financial software assists lenders estimate the risk of approving money to each and every personal homebuyer. Automation including allows mortgage lenders in order to arrange what financial brands wanted scam analysis, reducing the probability of scams and you will loss.