The basics

A compliant home loan was that loan that the authorities-sponsored offices regarding Federal national mortgage association or Freddie Mac are able to pick. Why these types of workplaces might possibly be selecting purchasing such a great mortgage is the fact that specified loan need meet up with the dollar limits place because of the organizations. Due to the fact government was linked very highly to these a couple organizations, Fannie mae and you may Freddie Mac have straight down credit will set you back than many other private loan providers. Because of this, they can promote down rates of interest to your mortgage loans you to create meet their requirements.

- Federal national mortgage association and you can Freddie Mac computer are produced to help balance this new mortgage markets. These teams have the ability to get away mortgage loans of private lenders then sell them just like the financial-backed ties. Because of this, these two enterprises are able to cover 80 per cent off conventional mortgage loans.

The new Upside

For many who have an adult, nonconforming home loan that suits the brand new standards towards the restrict count acceptance because of the bodies-paid enterprises, you’re entitled to refinance their home loan because the a compliant loan. You could bump away from certain significant deals in your interest every month. That way. If you are just setting out locate that loan, obtaining the authorities-paid agency backing makes it possible for you to decrease your interest rate. On rise in the utmost size of compliant loans, certain residents that have larger mortgage loans who would have been experienced jumbo funds can now benefit from the advantages.

- The level of the mortgage is among the most earliest treatment for see whether the loan amount can meet the requirements getting good compliant loan. No matter if going with a non-compliant loan is not fundamentally a bad option, to be able to score a compliant financing normally has the benefit of consumers far more confident advantages.

A low-compliant financing is what is offered to a debtor as he or she doesn’t meet with the qualifications to possess a conforming financing. Specific homebuyers will discover that is their only choice to own providing a home loan. New drawback of going with this particular type of financing would be the fact they typically can get a higher interest, it might has actually a lot more fees and you may insurance rates standards, and it also does not include the huge benefits given by a conforming financing.

The most really-recognized particular non-conforming loan ‘s the jumbo loan. Because of this the loan count is just too higher to meet the requirements regarding a conforming loan. Because the jumbo finance did not qualify, they truly are hard to promote on additional market. Lenders be shorter sure concerning the possibility to resell this type from home loan, so that they need to charges the better interest rate to your borrower and make upwards for this risk.

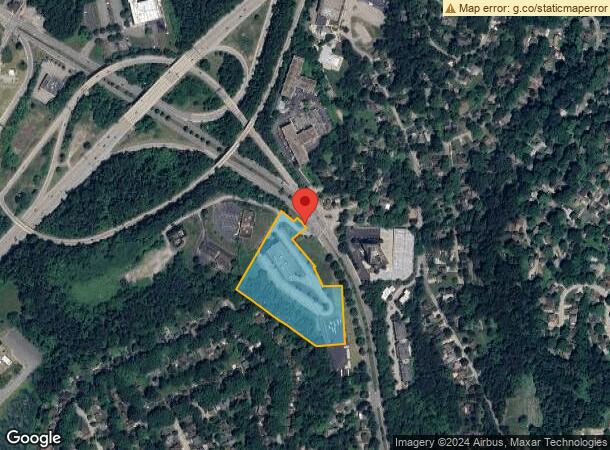

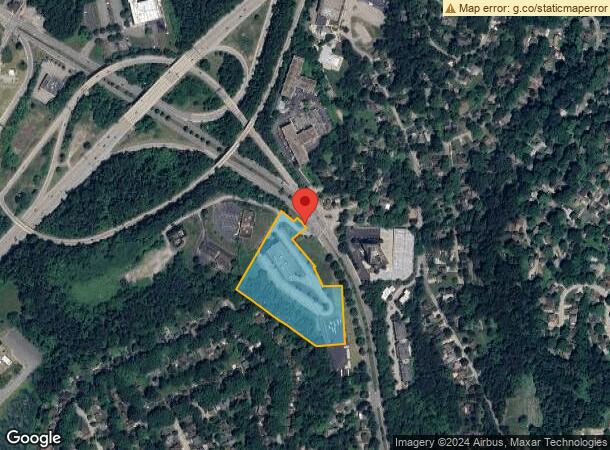

- In the most common areas, the fresh restrict having a conforming financing try $417,000. It amount will likely be increased whether your property is located in an area which have higher home values/will cost you out-of living.

- The most used cause for using a low-compliant financing try that it is required for a high-listed assets. This relates normally to 2nd home, individual funding properties, and you may luxury no. 1 homes.

Other Non-Compliant Funds

New jumbo financing is not the just sorts of home loan one to can not be classified because a conforming loan. Here are some other advice:

- Loan In order to Worthy of Ratio: It is the percentage of the brand new residence’s cost one is paid for which have home financing. Generally, you are permitted borrow around ninety% of your residential property pick and still meet with the certification having a great conforming mortgage. Beyond that, youre most likely not qualified to receive a conforming mortgage.

- Documentation Activities: In order to obtain a conforming mortgage, you need to be able to bring total a career history records, details about their property, and you may data files you to confirm your revenue. If you don’t have all of these details set up, you’re inside the qualified to receive a conforming mortgage.

- Finance Getting Applicants Which have Less than perfect credit Score and Credit score: Because 2009, it has been necessary that individuals wanting to found a conforming financing need to have good credit and you can credit rating.

easy bad credit loans in Weogufka

Money Of these With debt-To-Income Challenges: So it proportion is known as debt-to-earnings, just in case the taxes, insurance coverage, obligations costs, and you can monthly mortgage financial obligation add up to over forty-five% of your own monthly pretax money, you will possibly not qualify for a compliant financing.