Many homeowners call us and ask whether or not they is to rent or offer their property. (See Ought i Offer Otherwise Book My personal House? What is Your Attitude?) They are when you look at the a different relationships otherwise an alternative jobs and you will are quite ready to move on to the next thing of its lifetime. As we assess the pros and cons of these two choice, practical question constantly turns up “Do i need to rent out my house and just have another home loan so you’re able to pick a separate you to? How will that it really works?”

Exactly as after you taken out very first mortgage, the lending company got into consideration your income, the debt as well as your property designed for a down-payment whenever being qualified your for just what you could afford. Now your current mortgage commonly matter just like the a financial obligation and stay factored towards the algorithm for your the fresh mortgage.

So if your existing home loan are $1500 monthly, that is a personal debt which will be factored into the being qualified formula. Sure, I understand that you will be renting out your household and you can acquiring lease so you can counterbalance it debt, however, our company is inside old-fashioned moments now online installment loans South Carolina and lenders has actually to look at worst circumstances situation, i.elizabeth., let’s say that you don’t rent out your residence or you provides a multi-few days vacancy, would you be in a position to spend the money for the newest home loan?

Sure, I remember the great days of the past – pre-2008, in the event your most recent financial wasn’t sensed an obligations provided that because you demonstrated a rent towards the assets. The lending company don’t even guarantee the brand new book – people was indeed reduce and in love months. The good news is everyone is way more conventional – loan providers, appraisers, etcetera. – and you’ll become also. This conventional look at your current home loan is perfect for you as it suppresses you against overextending yourself and having for the obligations troubles.

- Basic, when you have leased your family for 12 months and you may can display 12 months regarding local rental income in your taxation return, your own lender will not number your existing mortgage debt toward your own the fresh new financial.

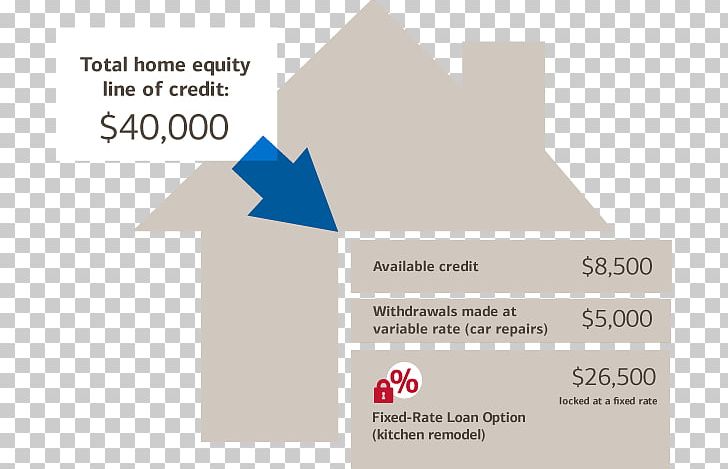

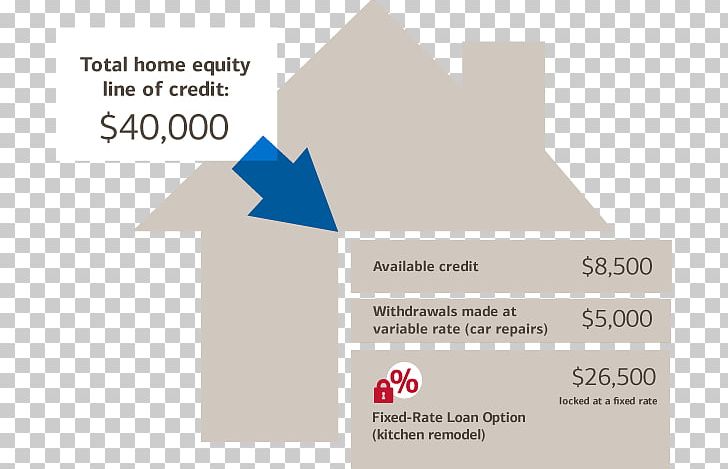

- And you may, second, it’s possible to have an appraisal done at your residence and if you have got sufficient collateral (usually at least twenty five% equity) and you will a freshly done lease, the lending company commonly count 75% of your own rental earnings to greatly help counterbalance the mortgage repayment.

Pose a question to your lender on those two conditions because they you will definitely range between financial to financial and you can financing system to mortgage program.

The majority of our people which ask us so it matter can afford to acquire an alternative household and you will rent the old you to definitely. The latest dating otherwise brand new job contributes money which allows this new citizen to carry both mortgages and also by employing Chesapeake Possessions Administration, new vacancy some time and dangers is actually considerably quicker.

A home Web log

Thus, yes, it does all work out. But pose a question to your financial this type of detailed questions one which just progress to the purchase.

After you Qualify to take A couple of Mortgage loans, Local rental Earnings Was Anticipate!

Then when i manage rent out your home, the cash disperse and you may leasing money are a welcome introduction in order to your own formula. as you have mainly based your brand-new get with the traditional numbers, this new leasing earnings is extra.

As nice as Chesapeake Property Management was at cutting risk when you are managing your home, we can’t bring your exposure right down to no and there will become occasional vacancy and you will repairs in your local rental home. By firmly taking the fresh conventional method, instead of the “rose-colored” servings means, when the unanticipated comes up on your own local rental property (a vacancy, a maintenance, an such like.), it will be easy to manage they easily. A much better state for everyone parties in it.

I am hoping this helps. For more in depth responses regarding the specific loan problem, we recommend your consult Jen Orner during the PrimeLending.