Jeff Gitlen, CEPF, is the movie director away from gains from the LendEDU. The guy finished from the Alfred Lerner School regarding Providers and you can Business economics in the College of Delaware.

PNC Financial Attributes, centered in the 1845, also offers a range of monetary functions also personal loans and you will lines of borrowing, checking and you will coupons account, Dvds, mortgage loans, plus a cellular percentage program. PNC also offers financial investments making use of their Wide range Administration system.

The lending company ‘s the result of a good merger ranging from Pittsburgh Federal Firm and you may Provident Federal Company. Over the past 150 many years, PNC is just about the 5th prominent financial throughout the U.S. with regards to number branch workplaces, and you may sixth prominent from the assets. It operates within the 19 claims, generally for the Eastern Coastline.

Providing a beneficial PNC Financial loan

PNC unsecured loans are around for both most recent and you can new customers. Regardless if you are seeking finance a large purchase, pay back a credit card otherwise scientific costs, or take a family trips, there is certainly a consumer loan tool out of PNC that can most likely see your needs.

PNC has the benefit of a couple fundamental version of signature loans: secured and you will unsecured. Because the you’ll expect, a protected consumer loan demands some type of collateral. A consumer loan cannot. Secured loans are usually used for entertainment automobile, boats, motorcycles, or any other personal explore car. The bank comes with an unsecured line of credit you to was susceptible to many of the same approval standards.

You could potentially sign up for financing having PNC Bank on foot with the some of the twigs or getting in touch with the new toll-100 % free count, but you can together with fill out an internet software if you are looking for a personal loan. You may need information regarding your existing and you will past target, Societal Shelter Number, annual money, employment, along with your cosigner’s pointers if you are planning to utilize with one.

Your credit score could be evaluated, and you’ll be offered your loan words if you find yourself recognized. If you have less than perfect credit, do not expect to become recognized. PNC will topic financing just to users having decent so you’re able to advanced level credit scores – essentially 700 and you may a lot more than.

PNC’s points aren’t available in all places, so you will need to be sure your zip code is actually one of its maintained components. The secured personal loans need to be stored that have non-a home guarantee, and PNC may well not give your 100% of your own property value you to definitely security.

To the unsecured personal bank loan, you can get between $1,000 and $thirty five,000 . While you are borrowing from the bank that have guarantee, the loan count can move up so you’re able to $100,000 that have at least deposit of $dos,000 . Pricing is actually payday loans Strasburg dependent upon your credit rating, the loan matter, and also the loan term. For good $ten,000 unsecured loan, you certainly will shell out between 5.74% Annual percentage rate and you will 7.74% Apr that have a payment per month around $315 and a phrase out-of 36 months.

For those who have a PNC bank account and just have your instalments automatically subtracted, you can also find a speeds write off away from 0.25 fee affairs There are more deals designed for certain facts also. All of the rates try fixed into the longevity of the mortgage, and you can terms was very versatile. You can get that loan having between 6 months to five age. The best rate you are able to spend is % .

PNC has no origination costs otherwise prepayment charges on the shielded and you can signature loans, therefore it can save you money when taking financing here.

Its personal line of credit, yet not, includes a great $fifty annual fee and an apartment, repaired price of 11.0% ount. The financing line has a continuous write months, to help you borrow and you can pay back as many times as you eg throughout that several months, same as credit cards.

So you can withdraw funds from a line of credit out of credit, you just go to an automatic teller machine otherwise establish a on the line to your savings account. Funds might possibly be directed and start to accrue attention as soon because you withdraw all of them.

The great benefits of PNC Unsecured loans

One of the biggest great things about PNC’s unsecured loans try their diminished origination charge or prepayment penalties. PNC’s automated percentage dismiss is yet another work with many other loan providers have gone away from. Also a good 0.25% lack of an ount of money from inside the accrued notice along the life of the borrowed funds.

PNC’s webpages even offers a wealth of academic articles, resources, and you can products so you can control your money, and understand the loan procedure, its mortgage points, and other financial properties.

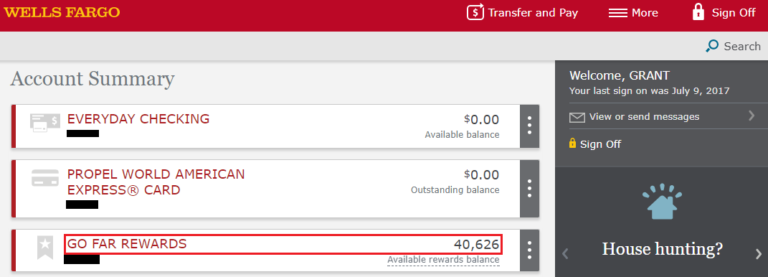

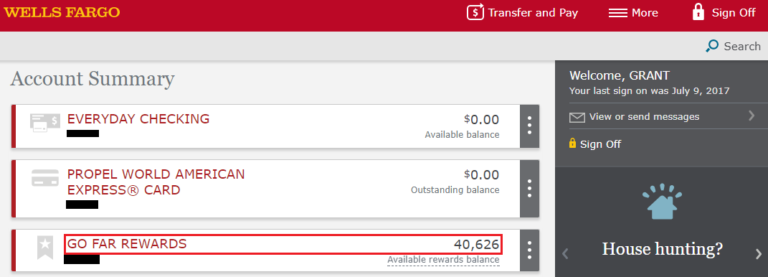

That have a completely-on the internet application for the loan process getting signature loans leaves PNC to your exact same level because the some of the far more convenient on the web lenders, such as LendingClub, or any other stone-and-mortar organizations that have transferred to on the web programs, eg Customers Financial and you will Wells Fargo. With many on line loan providers now offering extremely smoother lending processes, PNC’s on the internet app encourages their people to keep with them.

The fresh Cons regarding PNC Personal loans

Maybe not about PNC Lender are simpler, yet not. From inside the more than 120 ratings to the ConsumerAffairs over the last year, 110 of them have been just a few celebs otherwise down, with many consumers worrying in the checking costs, worst solution away from situations, and you can an internet screen that’s not affiliate-amicable.

If you are PNC’s loan pricing are great for a brick-and-mortar lender, they don’t really compare with new cost someone may within another type of organization, especially one that’s aiimed at an effective 100% on the internet experience. Do well, for instance, also provides funds that have an apr only cuatro.99% – almost a full payment area lower than PNC.

The bottom line

PNC may not have the best personal bank loan rates, although it does have a wider variance of borrowing products than just extremely on the internet loan providers, and is a well-built company. If you are searching to have debt consolidating choices or if you should make home improvements or a giant get, PNC is a viable choice.

- Understand the style of financing you need.

- Understand your credit report and you can what kind of interest rate you can expect.

- Learn your budget, and how much of a payment you really can afford.

When you have a handle your self financial predicament, you’ll be greatest willing to obtain the right type of private loan from the correct lender.

In order to maintain the free service to have customers, LendEDU both receives settlement when website subscribers click in order to, sign up for, otherwise buy factors seemed on sitepensation could possibly get feeling in which & how enterprises show up on the site. In addition, all of our writers do not constantly feedback every single team in every globe.