Conditional acceptance

Conditional home loan acceptance, either named pre-recognition , is a little such as being qualified getting a rush. The initial stage is actually trailing you, however, you’re not from the finishing line.

Regardless of this, conditional approval is going to be rewarding if you find yourself regarding the property markets. It assists you understand your own prospective borrowing fuel you is narrow down the newest properties which might be right for you.

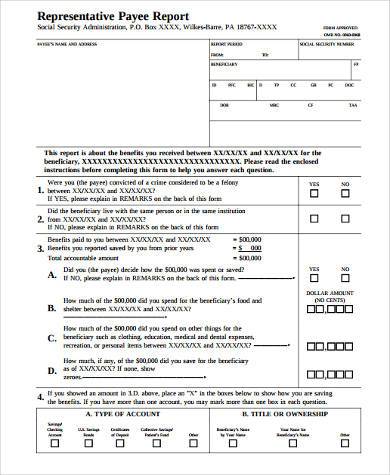

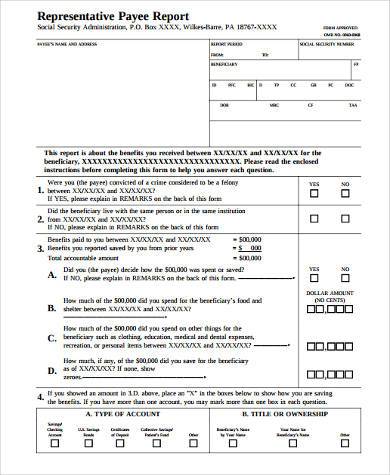

When you discovered conditional recognition, your own financial will receive examined your finances up against a primary set of the lending standards. In your app, you will need to offer documents like your ID, payslips, Pay-as-you-go descriptions and you can factual statements about your own property (like your coupons) and you can liabities (such as for example almost every other fund). You can even assume them to find out about your own regular month-to-month costs.

If you already have property at heart, lenders are likely to check on the home kind of, worthy of and urban area.

Since title ways, conditional acceptance is not last. Before you go to get, you will have to complete an entire app that suits this new lender’s complete number of approval requirements.

Normally, conditional recognition continues step three-6 months. In the event the property look stretches past it schedule, you might reapply with the same or an alternate bank. Always posting the initial data your submitted.

Unconditional acceptance

Once you discover an enthusiastic unconditional approval, the bank could have combed through your files, size of up your property’s really worth, and made sure you tick every boxes. You might pat your self on the back, nevertheless will most likely not suggest everything’s set in stone.

Unconditional approvals explanation the key areas of your residence mortgage, for instance the loan amount, the fresh new annual interest rate plus month-to-month, fortnightly and you may per week fees amounts. From the conditions, it’s really worth looking out for the word ‘subject to help expand bank requirements’. This means a few examples you certainly will affect the final decision.

- big alterations in your debts

- the financial reading errors on your own application

- the lender’s LMI (Lender’s Home loan Insurance coverage) seller maybe not granting the program.

1: Getting conditional recognition

After you have made your house application for the loan, it might be examined by the bank. If you’re profitable, then you will be considering conditional acceptance. That implies your application could have been assessed, but more details required.

Step two: Satisfying your conditional recognition

Your next tips can vary among lenders. They frequently ask for factual statements about your bank account (such as for example money and costs) and you may, if needed, information about a home you are interested in (such worth, city and kind).

Step 3: Begin looking to have properties

As a result of your conditional approval, you could potentially greatest know very well what you can afford. This could be a good time first off the fun region: house hunting.

You could use the conditional approval to inform your budget when you’re figuring out what you want. Wonder which features are low-negotiable and which can be ‘nice to have’. Are you looking for children home? Exactly what amenities do your area need to have?

Having conditional recognition will give you a beneficial advantage no matter where you appear. Assets providers go for pre-approvals, in order to be self assured providing even offers otherwise bidding in the deals. You may find sellers prioritise your own give because your finances are confirmed.

Step 4: Getting your unconditional approval

Just after a provider has actually accepted a deal, you both need to sign a binding agreement regarding revenue. A realtor will likely then upload that it to help you each of their solicitors or conveyancers having review before-going into lender.

Your own bank would need to do a final remark in advance of giving your property loan. When you’re winning, then you found unconditional recognition. You can now rest easy understanding your bank possess officially arranged to your home loan application.

Step: 5: Knowledge their unconditional approval

Today, you ought to make certain what you looks best. Take time so you’re able to very carefully realize and you can see the terminology and you can requirements.

Separate pointers of a great solicitor is a great solution to finest comprehend the criteria, in order to clarify anything you are unsure from the.

Action six: Atlanta installment loan with savings account Sign up the fresh dotted range

Their bank items a couple of mortgage records along with your unconditional acceptance. If you find yourself happy with everything you, you could potentially signal all of them. Keep in mind you need to do which from inside the timeframe your own lender considering. Your brand new house is just around the corner, so now is enough time to help you enjoy.

Step eight: The road towards this new property

Required sometime so you’re able to finalise the unconditional approval before settlement. This is certainly an ideal time for you make some last arrangements.

Since you mark nearer to settlement, its value doing a last check to evaluate the home are in the same standing while the if it are marketed to you. Doing so week or so ahead of payment lets enough time getting the vendor to respond to one things before you can move around in.

Basically, conditional acceptance offer suggestions and stay familiar with empower your possessions search. Unconditional recognition are able to be seen once the eco-friendly white, verifying that lender provides offered to provide you currency so you can get your fantasy assets.

Getting help with your home application for the loan otherwise ways to their home loan questions, get in touch to possess a free, no-duty session.