Ireland even offers attractive possibilities and you can vistas, so it’s not surprising that folks from all over the nation become here with hopes of installing sources and purchasing a house.

Navigating the loan field due to the fact a different federal may sound tough, that’s why you will find created this guide to assist overseas nationals understand the Irish mortgage market and you can navigate the borrowed funds software process.

Is overseas nationals get home financing from inside the Ireland?

The straightforward response is yes’. If you find yourself lawfully citizen into the Ireland, susceptible to specific requirements, youre permitted get a home loan in the Ireland. So it pertains to Eu/EEA people, and additionally low-EU/EEA citizens with a beneficial Stamp step 1, Stamp 1G otherwise Stamp cuatro.

With respect to the specific criteria out of a loan provider, apart from proving cost, you’ll basically be required to satisfy the bank than simply your have been living and dealing during the Ireland for the very least several months (e.grams., one year).

And that mortgages appear in Ireland?

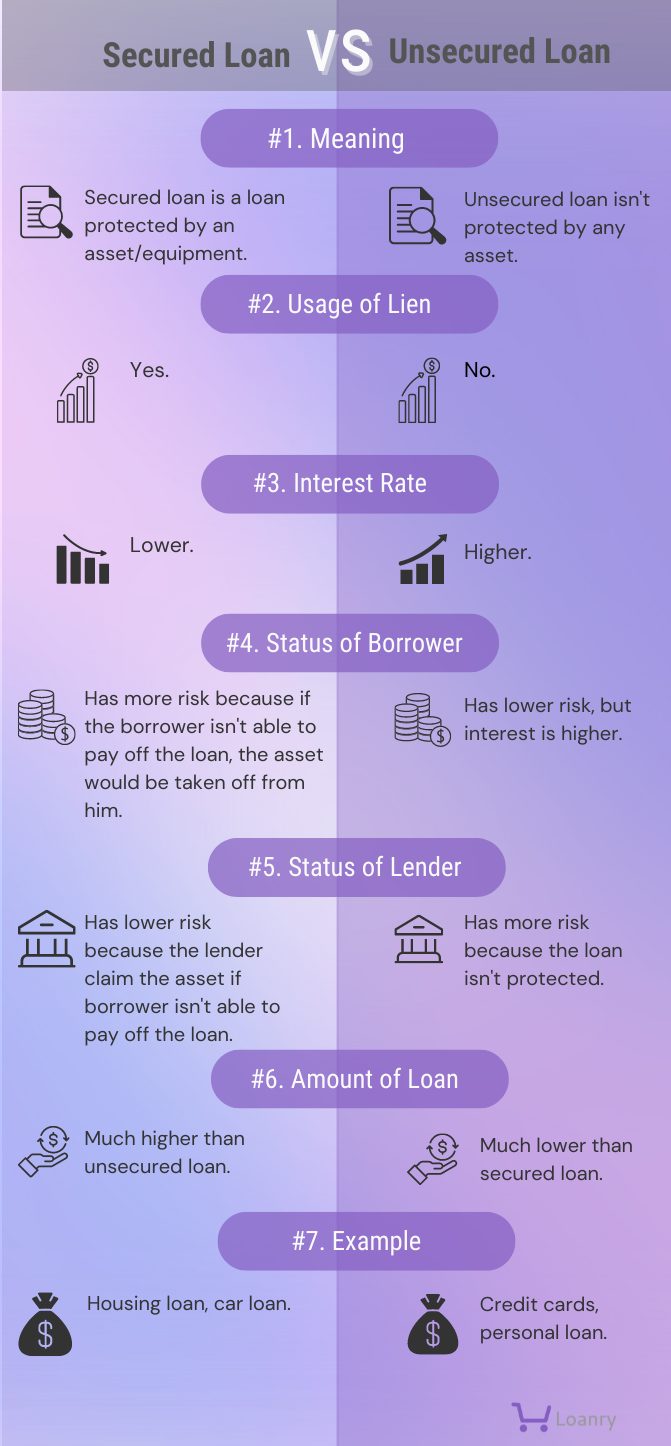

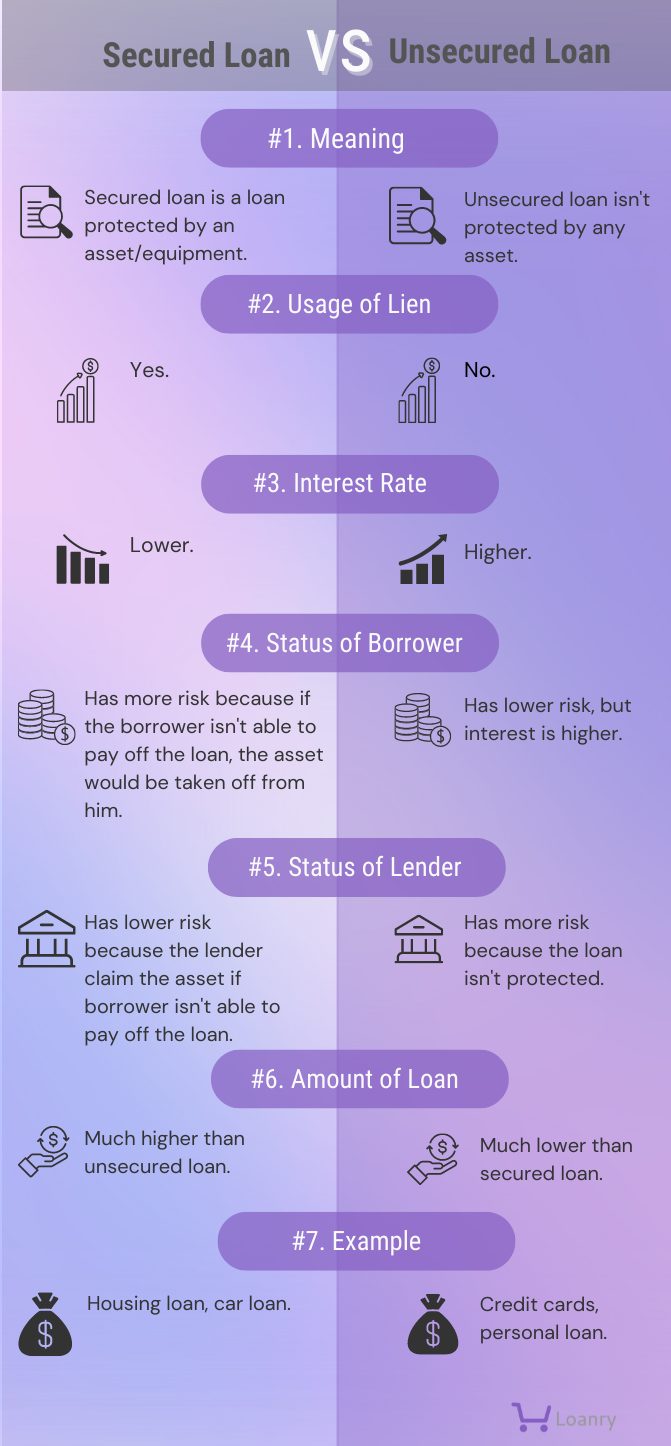

There are numerous home loan products to be had therefore we advise that you feel accustomed the various form of mortgages available and the way they really works.

The loan points available disagree to possess consumers based the specific possessions excursion. Instance, products accessible to very first-date buyers can differ out-of men and women offered to good mover otherwise someone who is to purchase a residential property.

Typically the most popular home loan device is the brand new installment financial. Lenders work out how far you ought to repay every month to settle the borrowed funds towards the end of the title. Their monthly repayments might possibly be made up of:

- An attraction percentage on financing, and you can

- A funds fees paid the bill.

Initial, much of your repayments is certainly going for the make payment on focus however, just like the money count reduces, the eye piece falls plus goes toward paying off the main city amount.

And therefore rates of interest apply?

When deciding on a home loan, the interest rate is actually an option factor as it plays good high region in the manner far you only pay in order to a loan provider for every day, plus total, across the duration of the borrowed funds.

Varying Costs

– Promote liberty and might allow you to shell out extra off their home loan, offer the phrase otherwise better it up without paying a penalty.

Fixed Cost

– Offer confidence because you know precisely simply how much your monthly repayments is and they will not raise that have interest rates.

– Unfortunately, you would not benefit from a reduction in the speed on time of the home loan. After that, should you want to use out-of a predetermined rate, elizabeth.g http://paydayloancolorado.net/two-buttes., if you decide to switch loan providers within the fixed rate months, you may have to spend a penalty commission.

Simply how much can you acquire?

New Central Lender off Ireland provides home loan measures positioned, mode constraints toward amount of cash loan providers normally provide to you, having fun with Financing-to-Worthy of (LTV) constraints and you will Loan so you’re able to Earnings (LTI) limits.

- LTV constraints indicate that you should have a certain put count before you can get a mortgage. These types of limitations varies according to whether you’re a primary-day buyer e.g. 90%, an additional and you will after that consumer elizabeth.g. 80%, or an investment property buyer elizabeth.g. 75%.

- LTI limitations limit extent you can borrow on the basis of your revenues. This maximum will not apply to consumers according out of financial support attributes or modifying the financial.

We recommend that you get proficient when you look at the home loan terms so do you know what loan providers are already speaking of. Our very own financial glossary publication simplifies home loan jargon that you’ll come upon during your mortgage travels.