- For those who have a premier credit rating, you could be eligible for lower-interest levels and higher financing terminology.

- Depending on if the mortgage was safeguarded otherwise unsecured, you could potentially chance shedding your property.

- High-interest rates suggest you could end up using a lot more than your own barn deserves.

Playing cards

Specific aspiring barn residents who don’t qualify for unsecured loans will get check out credit cards to invest in the formations, and is a slick hill.

Pros & Downsides

- You may need a top credit rating in order to be eligible for the best terms and conditions while the lowest interest rates.

- You can also qualify for rewards issues otherwise repeated-flyer miles depending on the creditor.

- Rates that have playing cards are going to be exceedingly higher and you may missing a repayment are going to be pricey.

If you have adequate money in the financial institution to afford cost of a pole barn, which percentage system is probably how to go.

Advantages & Cons

- You won’t have to worry about notice costs or monthly obligations.

- Depending on how much you have saved, you are stopping all of your nest egg.

- You’ll not qualify for all perks that you may possibly get by paying with credit cards.

Household Guarantee Line of credit

To possess current home owners, a property-equity line of credit (HELOC) is an attractive option since it enables you to borrow funds from your mortgage in lieu of connected with some other bank.

Experts & Drawbacks

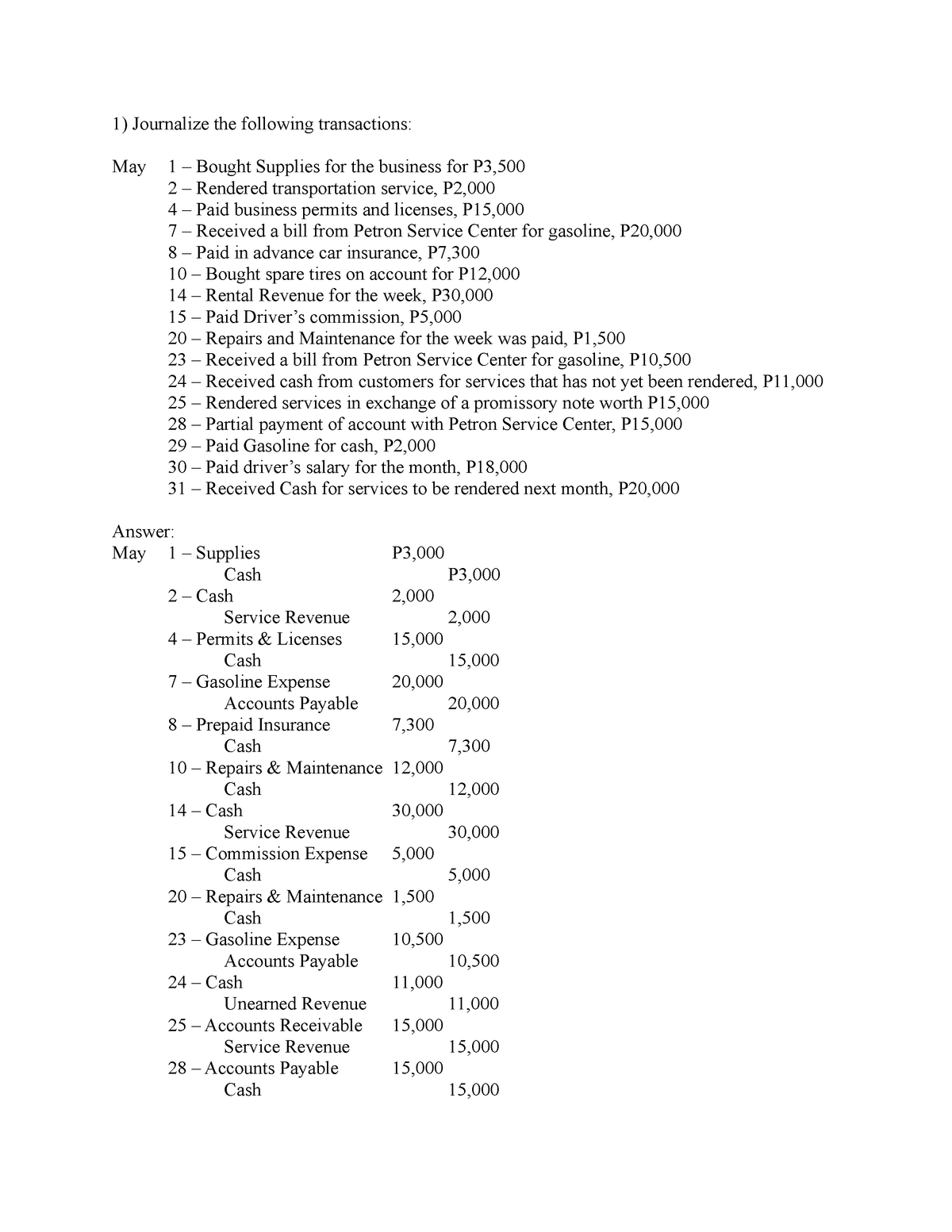

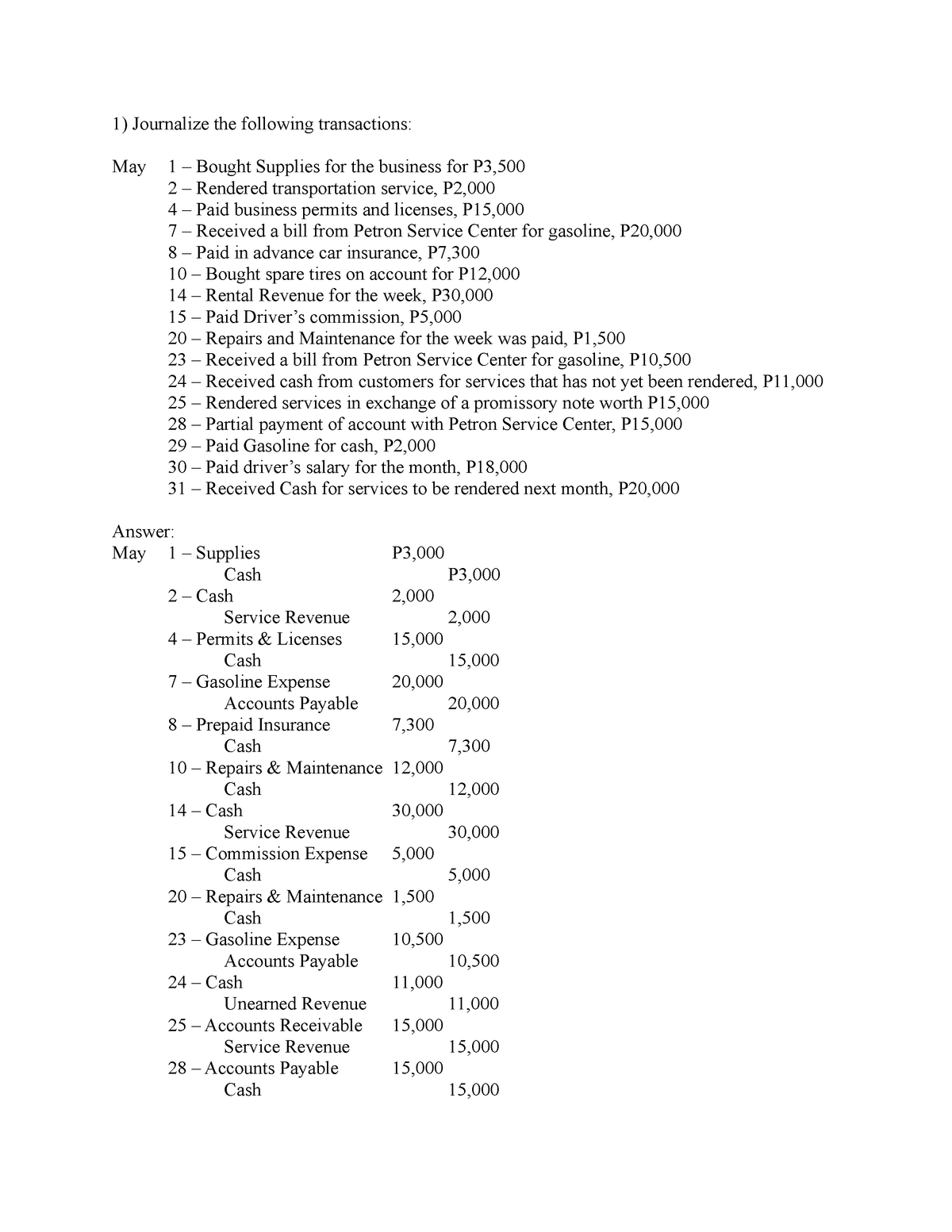

The kind of rod barn financing which is greatest usually is based on your finances and you may situation. Whenever you are a personal loan are ideal for you to definitely debtor, a house security financing is generally better for another. If you’re considering rod barn resource i encourage examining all available options. You can even be eligible for particular not someone else. This will make narrowing down the best choice simpler. Unsecured loans are usually among the trusted sorts of pole barn funding to help you qualify for, thus leading them to a famous solution. Likewise, unsecured personal loans do not require collateral or an advance payment. You can study way more or rating pre-qualified for a consumer loan at the Acorn Financing.

How long can you funds a beneficial barn?

If you utilize an unsecured loan, you might fund an excellent barn for as much as several age. Different types of money can offer some loan terms and conditions. The amount your use along with your credit rating may perception this new readily available terms and conditions. Such, for people who use $3,000 you probably are not considering a great twelve season label. While using a lengthier identity may help keep your commission off, they usually means that high desire costs. It is vital to make sure to is cover this new payment per month you is prevent selecting the longest name available only to have the reasonable commission you’ll be able to. In case the loan does not have an earlier prepayment penalty you may thought choosing an extended identity with the goal of make payment on mortgage regarding early. This enables you to getting committed to less monthly percentage. For people who spend more every month otherwise afford the mortgage from early you will want to save on notice.

Which is lesser adhere dependent barns or rod barns?

Very barn advantages would say you to definitely a pole barn isnt merely less however, better than a stick depending barn. Stick built barns usually are constructed on a tangible basements or crawlspace foundation. They use indoor wall space to possess help and generally do have more complex wall shaping. People like a pole barn over a stick mainly based barn once evaluating per solution. Rod barns can offer masters like. . installment loans in Idaho.